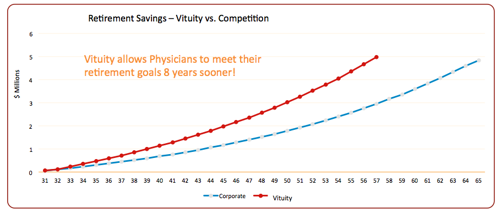

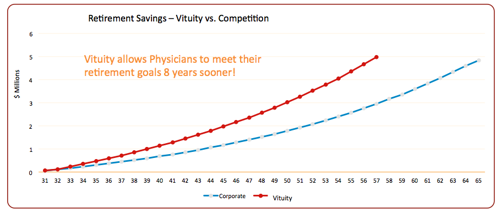

In relation to Vituity’s primary competitors, you will need to work eight years longer to reach your retirement goals.

Working clinical shifts can be mentally and physically exhausting, and the years and mileage can take their toll. Wouldn’t you rather have the option of retiring early in your 50s rather than at 65?

On top of the tax advantages, partnerships give physicians a voice in how their practice operates. Partners determine how much physicians should be paid on an hourly basis and how to invest or divide surplus funds. Vituity's local practices are supported by our national organization with financial planning, educational opportunities, and a wealth of other resources.

Close the Deal on Your Future

When conducting your first job search, do your homework on potential employers. Prepare a list of questions to ask during each interview. Take advantage of financial planning resources the prospective organization offers to help you understand how the company’s benefits compare to the competition.

Be objective about the salary and bonuses and consider the tax implications of the employment arrangement. Think about what will be the best choice for you in a decade when you are preparing to send your kids to college. Farther down the road, will you be able to scale back your workload or retire when you’d like?

Physician contracts are not “take it or leave it” propositions. There is room to negotiate on things like salary, loan forgiveness, and non-compete clauses. Remember to get everything in writing, because handshake deals are not legally binding. If you don’t like a contract provision, and there is no reasonable way to change the terms, then that is a strong signal to walk away.

Remember, the market is in your favor right now. Take your time, do your homework, and don’t be afraid to stand up for your interests. Thanks for reading, and good luck with your search!

Want to build a rewarding, long-term career with Vituity? Visit our Careers page to learn how.

Originally published August 14, 2018. Last updated March 28, 2019.