Q: Today, employed physicians outnumber self-employed physicians. How can a doctor's choice of practice model impact their finances?

Chris Renner: The employment model you choose can significantly impact your after-tax income, how much you save for retirement, and how early you're able to retire.

Many millennial job seekers are drawn to the employment model of corporations with a predictable schedule and a steady paycheck. They like the idea of having their employer take care of their health plan, their disability insurance, and their retirement.

Now, every doctor is different; maybe the employment model is ideal for some. But I think most physicians would appreciate the flexibility and financial benefits of being a Vituity partner.

Many physician job seekers don't fully understand the tax ramifications of working for a corporation versus a partnership. It's important to consider the full benefits package, not just the salary. In addition, being an owner in a physician partnership can provide significant advantages that typical employment doesn't offer.

For example, employers generally don't allow you to take deductions outside of a 401(k). By contrast, self-employed physicians can deduct expenses such as CMEs, health plan premiums, home office expenses, business-related cell phone costs, travel, and Internet costs.

Q: How does Vituity’s partnership model impact its providers?

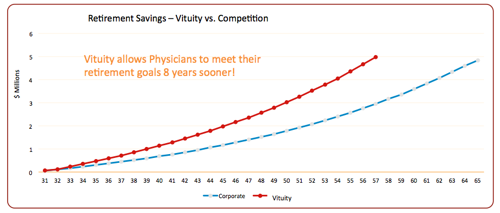

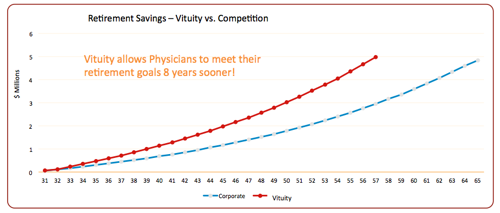

CR: Physician partners can shelter $96,000 a year between a 401(k) and a Defined Benefit Plan, while most corporate employers only let you set aside between $22,500 and $45,000 per year in a 401(k), including matching funds.

At many other groups, you’ll need to work eight years longer to reach your retirement goals than you would at Vituity.

Working clinical shifts can be mentally and physically exhausting, and the years and mileage can take their toll. Wouldn’t you rather have the option of reducing your shifts or retiring early in your 50s rather than at 65?

Q: Where should I invest my retirement savings?

CR: I recommend following what's called the hierarchy of savings. In a nutshell, after you’ve set aside emergency savings equal to three months of wages, when it comes to investment accounts, tax-free beats tax-deferred beats taxable.

Health Savings Accounts are tax-free accounts. So when you start investing, you should max that out first. Then move on to tax-deferred 401(k) plans and defined benefit plans. And finally, taxable investments would involve things like paying down student loan debt and saving for your kids' college because you're paying for them with after-tax dollars.

Of course, there are minor exceptions to this rule. For example, if your employer matches a certain percentage of your 401(k) contributions, you should prioritize enough contributions to get the full match.

Q: Can your location impact your financial future?

CR: Absolutely. I honestly don't think we talk about this enough, especially with the average medical school graduate carrying almost $200,000 in debt.

If you have some freedom around where you work, and if your primary goal is to pay off debt or save for the future, choosing the right location can be a huge help.

Location factors go beyond local physician salaries and cost of living. Check out income, sales, and property taxes in the state and region. It's also a good idea to look at the competition in your specialty should you want to change positions at some point. Also, consider the malpractice environment. Will you be stuck paying more for insurance due to unfavorable tort laws?

Ultimately, I believe that people should move to an area because they feel comfortable there. I often tell people to buy a house because they love it, not because of its investment potential. People should select their ultimate location the same way.

Q: What should physician job seekers ask potential employers/partners about benefits?

CR: When conducting your first job search, do your homework on potential employers. Online research reveals a lot, so make sure you’re up to date on each company’s stability of practice – particularly now. Prepare a list of questions to ask during each interview. Take advantage of financial planning resources the prospective organization offers to help you understand how the company’s benefits compare to the competition. At Vituity, we are 100% owned by our practicing physicians, so we work hard to make sure you have the resources you need to make the right financial decisions for you.

Be objective about the salary and bonuses and consider the tax implications of the employment arrangement. Ask yourself: what will be the best choice for me in a decade when I might be preparing to send my kids to college? Farther down the road, will I be able to scale back my workload or retire when I’d like?

Physician contracts are not “take it or leave it” propositions. There’s room to negotiate on things like salary, loan forgiveness, and non-compete clauses. Remember to get everything in writing because handshake deals aren’t legally binding. If you don’t like a contract provision, and there’s no reasonable way to change the terms, then that’s a strong signal to walk away.

Take your time, do your homework, and don’t be afraid to stand up for your interests.

Q: What's your biggest financial planning tip for new physicians?

CR: The biggest investment is you and building your practice reputation. Make sure you are empowered to make the right decisions in patient care.

Originally published September 5, 2019